The Facts About Paul B Insurance Medicare Supplement Agent Huntington Uncovered

Wiki Article

8 Simple Techniques For Paul B Insurance Local Medicare Agent Huntington

Table of ContentsAll About Paul B Insurance Medicare Advantage Plans HuntingtonIndicators on Paul B Insurance Medicare Health Advantage Huntington You Need To KnowA Biased View of Paul B Insurance Medicare Agent HuntingtonPaul B Insurance Medicare Agent Huntington for DummiesThe Best Guide To Paul B Insurance Medicare Advantage Plans HuntingtonPaul B Insurance Medicare Health Advantage Huntington Fundamentals Explained

As an example, for some measures, in 2022, if the rating on that particular procedure was less than the previous year, the ratings changed back to the 2021 worth to hold strategies safe. An added 2 percent of enrollees are in plans that were not ranked due to the fact that they remain in a strategy that is also new or has too reduced enrollment to obtain a score.

The star scores displayed in the number over are what beneficiaries saw when they picked a Medicare plan for 2023 and are various than what is utilized to figure out bonus offer settlements. In the last few years, Med, political action committee has actually increased concerns regarding the celebrity rating system as well as top quality perk program, including that celebrity scores are reported at the agreement instead of the strategy level, and also might not be a beneficial indicator of quality for beneficiaries since they consist of a lot of measures.

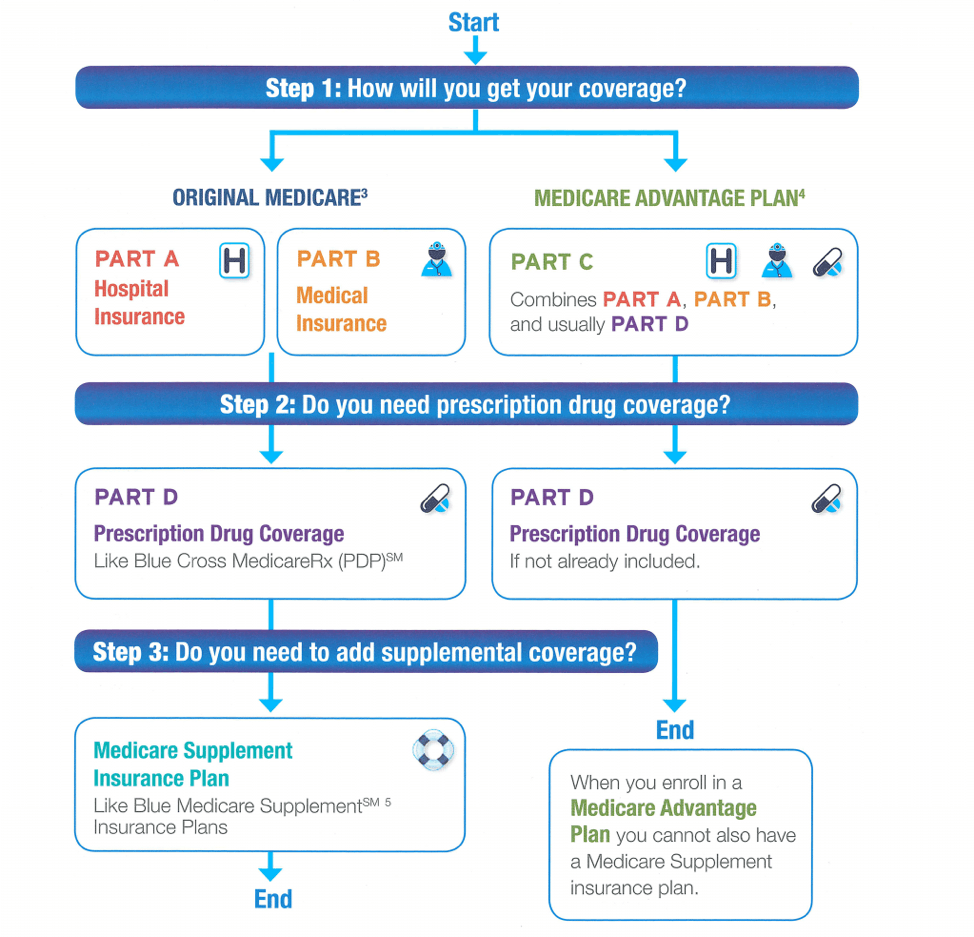

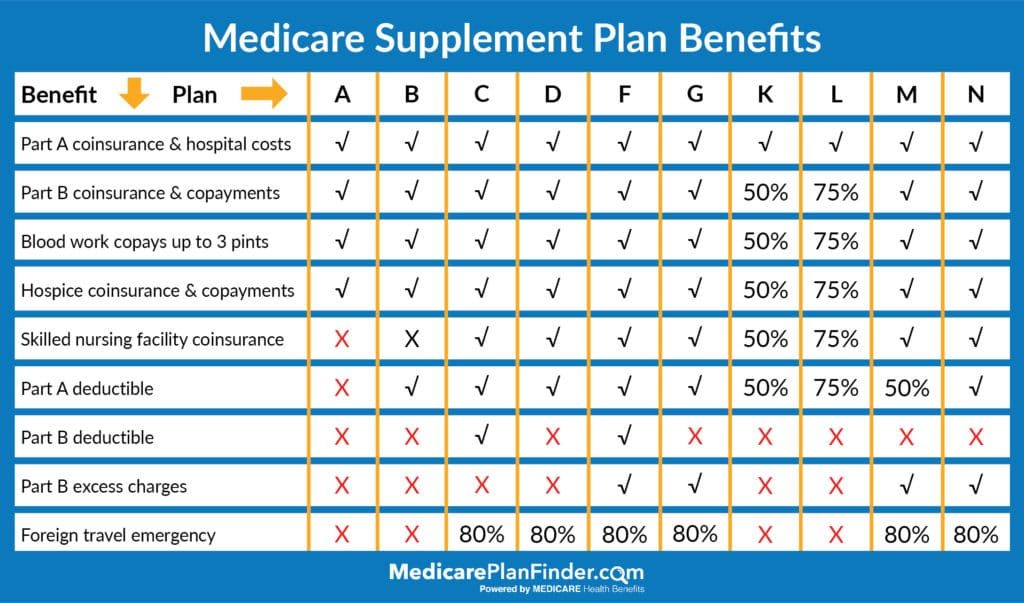

Choose a Medicare Supplement plan (Medigap) to cover copayments, coinsurance, deductibles, and various other expenditures not covered by Medicare.

Unknown Facts About Paul B Insurance Local Medicare Agent Huntington

An HMO might require you to live or function in its service location to be eligible for insurance coverage. HMOs commonly give integrated treatment and also focus on prevention as well as wellness. A kind of plan where you pay less if you make use of medical professionals, medical facilities, and various other healthcare providers that come from the plan's network.A type of health insurance where you pay much less if you utilize service providers in the plan's network. You can make use of doctors, hospitals, and service providers outside of the network without a recommendation for an additional cost.

Having an usual source of treatment has been discovered to boost high quality and also reduce unneeded treatment. Most of individuals age 65 and older reported having a normal company or place where they obtain treatment, with slightly higher rates among people in Medicare Benefit intends, people with diabetic issues, and individuals with high demands (see Appendix).

The Main Principles Of Paul B Insurance Medicare Agent Huntington

There were not statistically substantial distinctions in the share of older adults in Medicare Advantage prepares reporting that they would always or frequently get an answer about a medical concern the very same day they called their normal resource of treatment compared to those in traditional Medicare (see Appendix). A larger share of older adults in Medicare Advantage plans had a wellness care specialist they could conveniently speak to in between medical professional gos to for recommendations concerning their health condition (information disappointed).Evaluations by the Medicare Repayment Advisory Compensation (Medication, PAC) have actually revealed that, usually, these strategies have lower clinical loss ratios (suggesting greater revenues) than various other kinds of Medicare Benefit plans. This suggests that insurers' interest in offering these populaces will likely remain to grow. The findings also increases the crucial to check out these strategies separately from various other Medicare Benefit intends in order to make sure top quality, fair care.

In particular, Medicare Advantage enrollees are most likely than those in conventional Medicare to have a therapy strategy, to have a person that evaluates their prescriptions, and also to have a routine physician or area of care. By supplying this extra help, Medicare Benefit strategies are making it easier for enrollees to get the assistance they need to handle their healthcare conditions.

The Only Guide for Paul B Insurance Medicare Insurance Program Huntington

The study results additionally raise questions regarding whether Medicare Benefit plans are getting appropriate payments. Med, special-interest group estimates that plans are paid 4 percent greater than it would certainly set you back to cover comparable people in traditional Medicare. On the one hand, Medicare Benefit intends seem to be providing solutions that help their enrollees manage their visit here treatment, as well as this included care monitoring might be of substantial worth to both strategy enrollees and also the Medicare program.Part B complements your Part An insurance coverage to give insurance coverage both in as well as out of the hospital. As a matter of fact, Component An and Component B were the initial parts of Medicare created by the government. This is why the two parts together are frequently described as "Initial Medicare." Additionally, many people who do not have additional protection via a group plan (such as those supplied by companies) usually authorize up for Components An as well as B at the very same time.

The 4-Minute Rule for Paul B Insurance Medicare Insurance Program Huntington

The quantity of the costs varies amongst Medicare Benefit strategies. You might also have other out-of-pocket expenses, including copayments, coinsurance as well as deductibles. Medicare Benefit places a restriction on the amount you pay for your covered healthcare in a given year. This restriction is referred to as an out-of-pocket optimum. Initial Medicare does not have this function.As well as these networks can be extra effective in providing care. As a result, they reduce total health care costs. Some Medicare Advantage plans need you to use their network of providers. Others allow you to head to out-of-network providers, normally for a greater cost. As you discover your options, consider whether you intend to proceed seeing your existing physicians read review when you make the button to Medicare.

A Biased View of Paul B Insurance Insurance Agent For Medicare Huntington

What Medicare Supplement prepares cover: Medicare Supplement prepares assistance handle some out-of-pocket expenses that Original Medicare doesn't cover, including copayments as well as deductibles. That indicates Medicare Supplement plans are only readily available to people who are covered by Original Medicare. If you decide for a Medicare Benefit strategy, you're not qualified to buy a Medicare Supplement plan.Report this wiki page